The classes feature of QuickBooks is more difficult to describe

than to use. Every transaction must have an account assigned to it,

but optionally you may also assign a class if you want. So think of the Classes

list as like having a second chart of accounts which you can

apply to transactions to group them into

categories different from those provided by the Chart of

Accounts.

Accounts mostly organize transactions into financial

categories--income, expenses, payables, receivables, etc.--but classes let you organize transactions

into any categories you want. You

have full control over what those categories are. The

Classes list is empty when you first create a QuickBooks company

file, so you can set up any classes you want in it. Most often

you'll used classes for

grouping transactions into management information categories as opposed to

the financial accounting categories provided by the Chart of

Accounts.

You can

even use classes for "ad hoc" kinds of things.

Suppose a storm has

damaged some buildings and you need to keep track of all the repair

bills, so that later when repairs are completed you can submit a total bill to your insurance agent.

If you set up a Storm

Damage class and apply it to each of the repair transactions

you enter in QuickBooks, later you'll be able to

get a report for the Storm Damage class that (1) shows the dollar total

for storm damage repairs, and (2) lists each of the bills you paid

for storm-related repairs.

You can

even use classes for "ad hoc" kinds of things.

Suppose a storm has

damaged some buildings and you need to keep track of all the repair

bills, so that later when repairs are completed you can submit a total bill to your insurance agent.

If you set up a Storm

Damage class and apply it to each of the repair transactions

you enter in QuickBooks, later you'll be able to

get a report for the Storm Damage class that (1) shows the dollar total

for storm damage repairs, and (2) lists each of the bills you paid

for storm-related repairs.

But again, classes are most often used for getting management

information from your accounting records. Why? Because classes can

represent specific areas or subunits of your business rather than just financial and tax

categories. So they let you

get separate reports about the profitability of those subunits of

your business. Here are some examples of how classes may be

used for management information:

- A farmer may use classes to represent the different crops and

types of livestock he raises, so he can determine which areas of his

business are making a profit.

- An apartment manager might set up a class for each apartment

building, and maybe even subclasses representing the apartments

in each building. By tagging rent revenue and maintenance

expense transactions with the appropriate classes, she'll have

better information about which buildings or apartments are

"problem areas". Knowing that a

particular building has had high repair costs over a period of

time may help with decisions about whether to

continue operating the building or to sell it.

- A manufacturer of running shoes might set up different classes

for each step in the manufacturing process, to better understand

labor and materials costs for each step. Or he might set

up a class for each model of shoe produced, to know

what each shoe model costs to produce.

- A trucking/transportation company could set up a different

class to represent each truck in his fleet, allowing him to keep

track of revenue, down time, repair costs, and fuel expenses for

each each truck.

All of this relates to a branch of accounting known as managerial

accounting, which is all about keeping and analyzing

records in a way that provides useful management information. Using

classes doesn't constitute a full managerial accounting system, but

it can go a long way toward improving the information you have about

your business without a lot of effort.

|

Can't find your Classes list? Click on Lists

in QuickBooks' main menu, and if you don't see a Class

list item in the submenu, then the classes feature

isn't enabled. To turn it on:

-

Click on Edit > Preferences in the main

menu, to open the Preferences window.

-

Click on the Accounting icon in the left pane

of the Preferences window.

-

Select the Company Preferences tab in the

right pane.

-

Check mark the Use class tracking item

on the Company Preferences tab.

-

Click OK to close the Preferences

window.

After completing these steps, a Class column will appear in many

of QuickBooks' form windows. In some cases such as for invoices, you may have

to customize the form's template to have the Class column appear.

|

Classes for Management Information: An Example

Here's an example of how classes might be used for better

management information in a trucking company. Even if you are not

interested in the trucking business, please read on. This is a

simple example that should give you basic ideas about how to use classes in

any kind of business.

Here's an example of how classes might be used for better

management information in a trucking company. Even if you are not

interested in the trucking business, please read on. This is a

simple example that should give you basic ideas about how to use classes in

any kind of business.

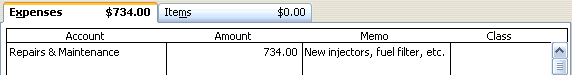

Suppose you have

several trucks or maybe a fleet of trucks, and you'd like to know how

costs for repairs, fuel, and so on compare among the trucks in your fleet. The

basics of gathering repair expenses involves assigning a Repairs

account when you enter transactions in QuickBooks:

This is fine for tax records, but of course it won't associate

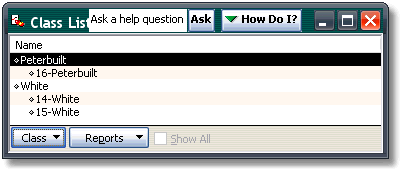

this repair expense with a specific truck. For that, you need to

set up a class for each truck and apply those classes to your

QuickBooks transaction entries for

repairs, fuel, etc. Here is a simple Classes list for a

"fleet" of three trucks:

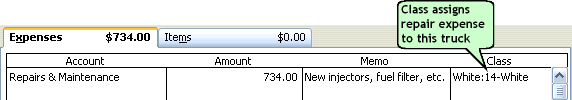

And here is the same QuickBooks transaction as above, but with a

truck class assigned to the repair expense, to associate it

with a specific truck:

|

"Why should I use classes here? Couldn't I just

set up a subaccount below Repairs for each truck? That would let

me keep track of individual truck repair costs without bothering to

use classes." Sure,

let's suppose you do that. If you have 20 trucks you'll need 20 subaccounts of the Repairs account. Simple and easy. But tomorrow you decide

"Hey, I'd like to keep track of fuel expenses for each truck,

too." What then? You'll have to create 20 sub accounts of the

Fuel expense account. And if you later want to track Lubricants

expense for each truck, you'll need 20 more Lubricants sub accounts... You

can see where this is going. Eventually your Chart

of Accounts would grow to be large, messy, and difficult to use. There'd be other problems too. Getting a report showing the total Repair, Fuel, and

Lubricants expense for one particular truck would be tedious:

you'd have to filter the report to include the correct subaccounts

of each of several main accounts. And what if buy another truck? You'll need to locate every account where trucks are

identified as subaccounts, and add a new subaccount for the new truck

in all of those places. In the long run, using classes to

identify individual trucks is by far

the simpler approach. You'll find additional discussion on this

concept below, see: The Golden Rule

of Account and Class Setup.

|

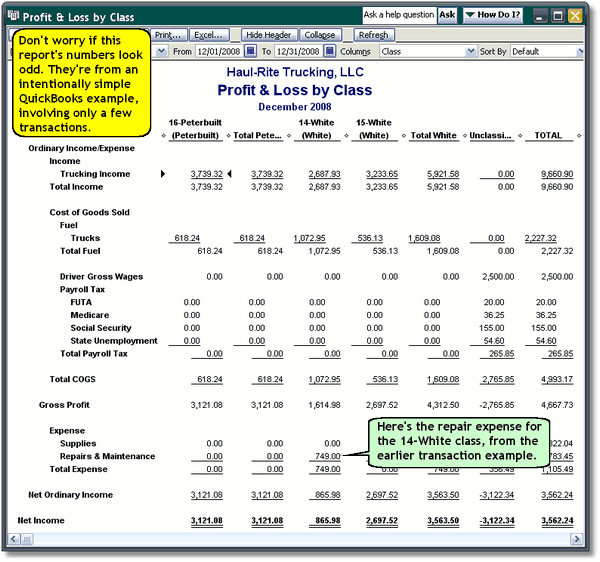

If you've assigned truck classes to all the

appropriate expense transactions, then at the end of the year or whenever you

like, you can get a Profit & Loss by Class report in QuickBooks,

showing

expenses separately for each truck:

Useful? ...Well Almost

Being the sharp manager you are, you already see a problem with

the report shown above. Just knowing the total repair

expenses for each truck isn't very useful information, because some trucks

may have run 175,000 miles last year while others only ran 100,000

miles.

What you need to know is repair cost per mile--that would give you something really useful for

deciding which trucks to keep or to trade, how many miles to run

trucks before rising repair costs suggest swapping them out for

newer models, and so on. Unfortunately, QuickBooks' Class reports only provide dollar

amounts. They cannot associate production or use information

with each class, such as the number of miles driven by

each truck, and get a report that shows expenses on a cost-per-mile basis.

But is there a way I can get a report like that? Yes, but you'll need a third-party reporting tool

specifically designed for to reveal cost-per-unit types of

information, such as our ManagePLUS

for QuickBooks product.

ManagePLUS

imports a copy of QuickBooks lists like the Chart of Accounts and

Classes list, lets you

associate "extra" information with list items--like

associating mileage driven with each truck class. Using this extra

information it can generate reports

that show revenue and expenses on a per-unit basis (in this case,

per mile) and other

related statistics and information.

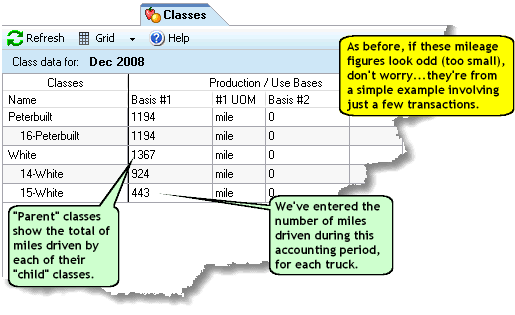

Here's a screen shot of the

Classes tab in ManagePLUS, where

units of production or use can be entered to associate them with individual classes:

And here are a couple of Profit and Loss with Classes Report

examples, showing cost-per-unit detail for individual classes. The

first relates to our discussion of trucking costs. The second is a

report for a farm business (demonstrating that this reporting

approach applies to any business where classes are used).

|

Click on

either thumbnail image below to see it full size.

Then if the pop-up image

is too small, click on it to zoom in.

|

|

Profit & Loss with Classes report - Trucking Example

This one is based on the discussion above, and shows truck

revenue, fuel, and repair expenses on a per-mile basis for a small

set of example transactions.

(Created with ManagePLUS

for QuickBooks)

|

|

|

|

Profit & Loss with Classes report - Farm Example

This image shows the income section (only) of a profit & loss report for

a farm business. It shows average per-unit prices received (price per

bushel of grain, per pound of livestock, etc.), average crop gross income per

acre and crop yield per acre, average weights of livestock sold, etc.

(Created with ManagePLUS

for QuickBooks)

|

|

|

This kind of reporting capability greatly enhances the management

value of information provided by classes:

- A farmer can see his fertilizer, seed, fuel, chemicals and repair

expenses on a per-acre basis, or per bushel produced, or per dollar of

crop revenue, etc.

- An apartment manager cab see apartment unit

maintenance expenses on a per-tenant-month or per-rental-dollar

basis.

- A manufacturer of running shoes can determine his direct labor and materials costs per shoe, for each shoe

model he produces.

- A trucking/transportation company can get reports of

various truck operating costs per mile driven, or per driver hour, or

per dollar of freight revenue, etc.

Allocating Overhead (Moving Toward Cost Accounting)

The kind of per-unit analysis of revenue and expenses described

above is something any business can accomplish with

little additional accounting effort beyond that needed for entering

transactions--whether you use QuickBooks alone, or an add-on like ManagePLUS.

But this simple approach is only helpful for getting

information only about direct costs--costs that can be

associated directly with a specific department or activity, like

repairs to a specific truck, fertilizer applied to a specific crop,

maintenance on a specific apartment unit, or materials costs for a

specific model of running shoe.

And while this approach is

simple and easy, it doesn't describe

the full costs of producing something. For that, you need to include

indirect or overhead costs--things like office

expenses, deprecation on machinery, utilities expenses, and so on. The usual

approach to handling these kinds of expenses is to allocate them to your various classes on some kind of reasonable basis.

For instance, you might divide total office expenses by the number

of trucks in the fleet and allocate the resulting amount to each

truck as its fair share of office expense overhead. If you're a

rental property manager, you would allocate things like lawn mowing,

maintenance wages, and maintenance supplies expenses to each

apartment complex you oversee, or even to individual apartments

(doing the latter would help you get an idea of total expenses per

apartment unit, as a comparison against the rental rate you're

charging). In fact, all indirect/overhead types of expenses should

normally be allocated among the profit-generating parts or

departments of the business.

How do you allocate overhead in QuickBooks?

- Accumulate costs by class in the normal way, assigning

classes when you enter expense transactions in QuickBooks. But

set up some additional classes for overhead cost areas of the

business, and assign those to transactions wherever appropriate.

These might be classes like Office and Administrative or Maintenance

Shop.

- At the end of the period (month, quarter, year, etc.), run

a Profit and Loss by Class report to get totals for

the overhead classes. You need to know the amounts available for

allocating to other classes.

- Add a new account to use in making allocation Journal

entries (in step 4 below). Call it Overhead Allocation,

or anything else that will remind you its purpose is to

represent allocated expenses. Assign the Other Expense

account type, so reports won't list this account along with

other (direct) Expense account type's lines. Rather, this

account will appear separately on reports, below the subtotaled

expenses.

Note: On the Profit and Loss reports of any individual

class, this account will show the balance allocated to that

class; however, the balance of this account will always be zero,

because it will only be used for transferring amounts between

classes. (The next step illustrates this.)

- Make Journal entries to allocate the overhead classes' amounts

to your profit center classes on some reasonable basis. Each Journal entry should include (1) a line debiting the Overhead

Allocation account for the total amount to be allocated,

with the overhead class identified in the Class column, and (2)

multiple lines--one for each profit center class--crediting Overhead

Allocation for the amount that class is to be allocated.

Note that the net effect of each Journal entry will be to leave

the Overhead Allocation

account's balance at zero, because it is debited

and credited by the same amount.

|

A profit center is an area or department of

your business that you operate for the purpose of

generating a profit.

A main goal of cost accounting is to evaluate whether

each of those areas is profitable. To do that, you prepare

a profit and loss reports for each profit center after (1)

accumulating its direct incomes and expenses by applying

classes when you enter transactions, and (2) allocating

each profit center an appropriate share of overhead costs.

|

The tough part of making allocations this way is that last step.

You have to understand debits and credits, and the total for the

credit lines must equal the amount of the debit line. But that's not even

close to being the

tedious part: what's worse is that you'll have to figure out

what dollar

amount to allocate to each profit center.

Suppose you accumulated $4355 for the Office &

Administrative class for the month, and you will allocate it

among five profit centers. If you want to allocating 15% to one

profit center, 20% to each of two others, 18% to a fourth, and the

remainder (37%) to a fifth profit center...well, it's time to grab

your calculator and get to work! If you have four overhead classes

and five profit centers you have twenty calculations to do...and a

lot of opportunities for error, both in the calculations and in entering all those numbers in your Journal entries.

In the real world, anyone who does much allocation typically

uses a spreadsheet program for the calculations. But the calculated dollar amounts

still have to be manually entered in your

Journal entries. So there remain plenty of places for errors to

creep in, which means you'll be spending a lot of time getting

everything checked over and entered correctly.

Is there a more automated way? Yes! You can use a

QuickBooks add-on to handle all the allocations. Our ManagePLUS

Gold for QuickBooks product is one of those. It gathers the

amounts assigned to each of your classes by QuickBooks transactions,

then lets you allocate among classes by drag-and-drop with the

mouse--no journal entries nor a calculator or spreadsheet are

needed.

If you allocate based on percentages, ManagePLUS Gold stores them so you can re-use them again next

period if you want. It also gives you the option of allocating costs

based on management quantities like hours of labor or units

of production associated with the target profit centers. For example, if each truck

operated by a trucking company is viewed

as a profit center--i.e., there's a profit center class for each

truck--you can associate the number of miles driven with each truck

class. ManagePLUS Gold could then automatically split Office &

Administrative expense among all of the truck classes based on mileage

driven during the period.

Want to know more? A good place to

start is with learning about basic cost accounting concepts,

like profit centers

and cost centers.

Getting Off to a Good Start...

The Classes list in QuickBooks can have up to five levels (classes

and subclasses), and class reports summarize information at each of

those levels. To have class information arranged in reports in a way that provides the

most benefit, it helps to give

some thought to how the list should be structured.

One last point about classes: Originally Intuit designed

the classes feature to work just with income and expense transactions.

Using and getting reports on classes used in income and expense

transactions is simple and straightforward--there are no pitfalls

involved and no surprises. However, recent QuickBooks releases--of

QuickBooks Premier and higher editions--also let you apply classes to balance

sheet-related (asset, liability, or equity account) transactions,

and get a Balance Sheet by Class report. This feature can provide

useful information, but there are a lot of potential "gotcha's"

involved. So be sure you understand the accounting requirements and

limitations before you begin attaching classes to balance

sheet-related transactions.