Part of the QuickBooks Cookbook™ Series...

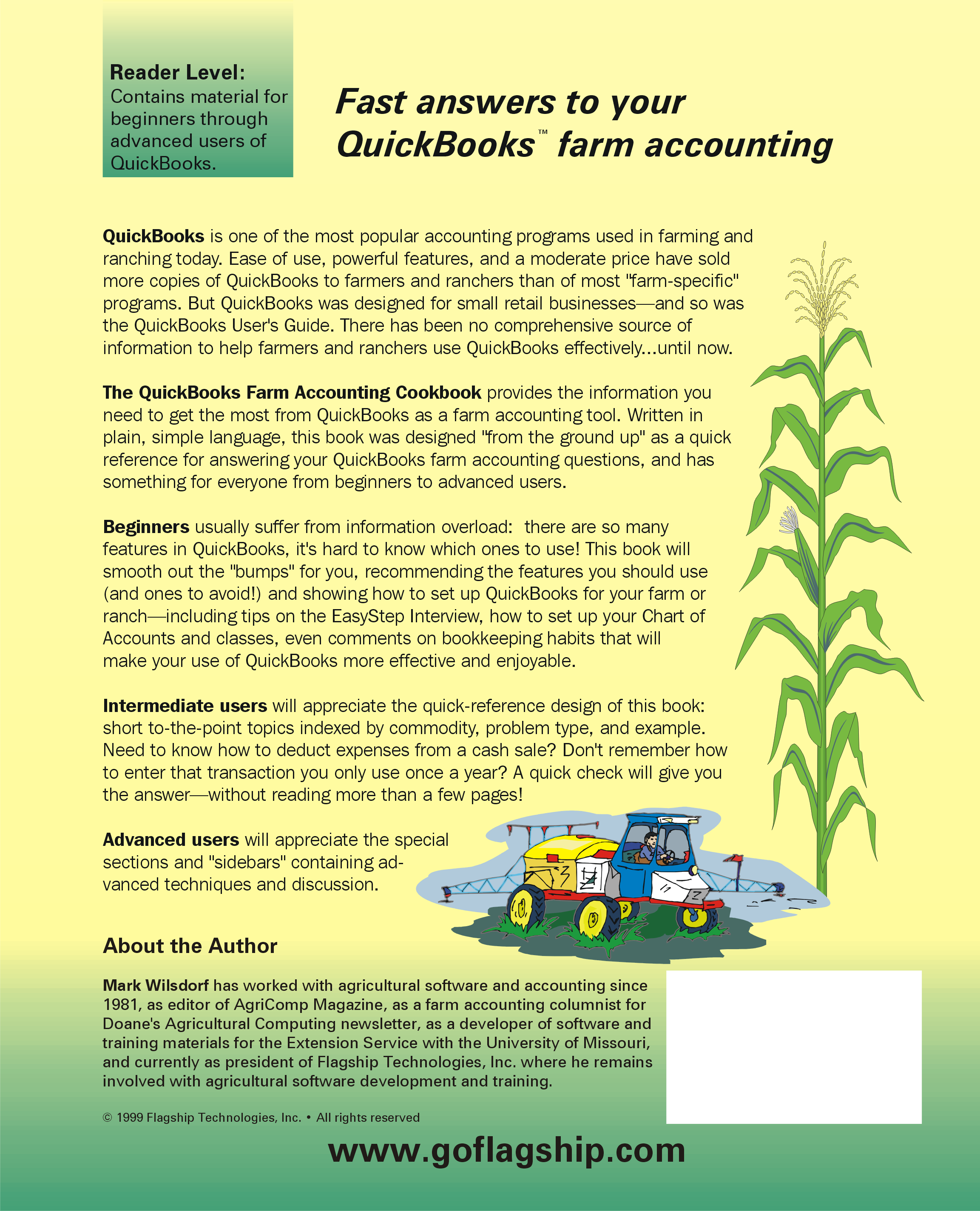

The QuickBooks Farm Accounting Cookbook™, Volume I

QuickBooks Basics, Income & Expenses, and More...

by Mark Wilsdorf

![]() This book has nothing to do with cooking! The QuickBooks Farm Accounting Cookbook™, Volume I is a 370 page how-to guide and reference for anyone who uses the QuickBooks software in agriculture...

This book has nothing to do with cooking! The QuickBooks Farm Accounting Cookbook™, Volume I is a 370 page how-to guide and reference for anyone who uses the QuickBooks software in agriculture...

...farmers, ranchers, accountants, tax preparers, extension personnel, and teachers and students of vocational agriculture. It is the comprehensive reference for farm/ranch accounting with QuickBooks. |

"I keep borrowing this book from my mother-in-law...it's time I owned my own copy. Very good for all levels of QB users :)" D. Parrott - Danville, IA |

(Prices on ordering page)

Series: Quickbooks Cookbook™ |

Pages 93-96. From Chapter 5, includes part of the topic Where to Enter Farm Expenses: ...as Checks? ...as Bills? ...as Credit Card Charges?

|

Pages 104-106. From Chapter 5, includes the topic How to Deduct Cash Discounts from a Check or Bill.

|

Pages 123-126. From Chapter 5, includes the topic Using Purchase Orders to Keep Track of Ordered Items.

|

Pages 202-204. From Chapter 5, includes part of the topic Keeping Track of Livestock Purchased for Resale.

|

These files contain copyrighted material, © Flagship Technologies, Inc., 1999. All rights reserved. (Prices on ordering page) |

| Table of Contents (detailed) |

Introduction |

1 |

Chapter 1 - Basic Decisions & Things to Know |

5 |

Do I Need QuickBooks or QuickBooks Pro? |

5 |

Separating Farm and Personal Funds...Or Not (How to Bend the Rules) |

6 |

Cash vs. Accrual Accounting |

9 |

Single- vs. Double-entry Accounting |

10 |

Chapter 2 - Setting Up a New QuickBooks Company |

13 |

The EasyStep Interview |

13 |

Setting Preferences |

23 |

Setting Up QuickBooks for Your Printer(s) |

30 |

Chapter 3 - Setting Up Accounts, Classes, and Other QuickBooks Lists |

33 |

About QuickBooks Lists |

34 |

Setting Up a Chart of Accounts |

35 |

Setting Up Classes: Enterprise Information and More |

59 |

Items: Identifiers for the Things You Buy and Sell |

68 |

Name Lists: Customers, Vendors, and More |

76 |

Chapter 4 - Getting Real Work Done with QuickBooks! |

81 |

New Users: Try the Navigator |

81 |

Keep Your Records Current! |

83 |

Use the Reminders Window |

83 |

Manage Your Bill Payments with QuickBooks |

84 |

Use QuickFill to Speed Transaction Entry |

85 |

Let QuickBooks Help You Reconcile Your Checkbook and Credit Cards |

86 |

Use Memorized Transactions? |

86 |

Let QuickBooks Print Your Checks! |

87 |

Use QuickBooks’ Inventory Features Carefully |

89 |

Learn to Use Forms and Registers |

90 |

Chapter 5 - Farm Expenses & Payables |

93 |

Where to Enter Farm Expenses ...as Checks? ...Bills? ...Credit Card Charges? |

93 |

Working with Bank Accounts |

95 |

Entering Checks |

100 |

Deducting Cash Discounts from a Check or a Bill |

104 |

Printing Checks from QuickBooks |

105 |

Working with Bills |

108 |

Entering Bills from Vendors (Accounts Payable) |

112 |

Entering & Applying Credits on Account (Issued by a Vendor) |

115 |

Handling a Refund of Your Account’s Credit Balance (from a Vendor) |

118 |

Paying Bills and Applying Credits on Account |

120 |

Using Purchase Orders to Keep Track of Ordered Items |

123 |

Paying Expenses with the Farm’s Cash (Petty Cash) |

126 |

Paying Farm Expenses with Non-Farm Funds (Personal Cash, Checks, or Credit Cards) |

127 |

Working with Credit Cards |

134 |

Chapter 6 - Farm Income & Receivables |

145 |

Where to Enter Farm Sales/Income ...in a Deposit? ...Cash Sale? ...Invoice? |

145 |

Entering Sales the Simple Way, as a Bank Deposit |

148 |

Entering Deductions (Yardage, Hauling, Commissions, etc.) from Bank Deposits |

151 |

Withholding Cash from a Bank Deposit |

152 |

Income from Refunds & Rebates |

154 |

Recording Sales Dollars and Quantities: The Cash Sales Form |

155 |

Entering Deductions (Yardage, Hauling, Commissions, etc.) on Cash Sales Forms & Invoices |

158 |

A Simple Way to Track What You’re Owed: “Pending” Cash Sales |

160 |

Need to Track Customer Accounts and Print Statements? Use Invoices |

163 |

Entering Farm Income Received as Cash |

169 |

Chapter 7 - Quantity Information in Income & Expense Transactions |

173 |

Including Quantity Information in Your Transactions |

173 |

Entering Two Quantities in Income and Expense Transactions (Requires ManagePLUS) |

179 |

Entering Quantities as Mathematical Formulas |

181 |

Tracking Weighted Average Grade or Quality Information (Requires ManagePLUS) |

184 |

Chapter 8 - Special Income, Expense, and Miscellaneous Examples |

187 |

Handling Farm Production as Inventory: a Grain Inventory Example |

187 |

Keeping Track of Livestock Purchased for Resale |

199 |

Entering Milk Sales Income |

210 |

Recording Patronage Dividend Income (Distributions from Cooperatives) |

221 |

Tracking Forward Contracts as Pending Cash Sales |

224 |

Your Tax Planning & Tax Preparation Options |

228 |

Chapter 9 - Accounting Techniques to “Pick & Choose” |

228 |

The “Best” Way to Keep Track of Cash Spending & Cash Income |

231 |

Maintaining the Farm’s Cash Fund (Petty Cash) |

237 |

Using a Non-Farm Funds Account |

243 |

Keeping Non-Farm Income & Expense Records in the Farm Accounts |

251 |

Automating Recurring Transactions |

260 |

Managing QuickBooks Lists: Reordering, Merging, Deleting, and Hiding List Entries |

271 |

Chapter 10 - Farm Asset Basics |

279 |

Simple Fixed Asset Accounting for Tax Records |

282 |

Accounting for Market Value Balance Sheets |

285 |

Accounting for Asset Book Values: Depreciation & Other Stuff |

290 |

Chapter 11 - Farm Loan Basics |

307 |

Setting Up Accounts for Loan Liabilities |

307 |

Entering Loan Proceeds (Receiving Borrowed Funds) |

310 |

Entering Loan Payments |

316 |

Getting Information on Loan Payments and Unpaid Balances |

319 |

Chapter 12 - Essential QuickBooks Reports |

323 |

Report Basics: The Profit and Loss Report |

323 |

Preparing a Balance Sheet Report |

331 |

Preparing Income Tax Reports |

342 |

Chapter 13 - QuickBooks “Housekeeping” |

349 |

QuickBooks Data Files |

349 |

Backing Up Your Records |

351 |

When Something Seems Wrong: Verifying/Rebuilding/Restoring Data Files |

355 |

Keeping Transaction Details: Archiving and Condensing the Company File |

357 |

Appendix A: Other Resources & Information |

361 |

Appendix B: QuickBooks List Capacities |

363 |

Index |

365 |

If you purchase the ebook edition you can be reading it in minutes on any of these devices: ▪Microsoft Windows PCs ▪Apple Mac PCs ▪Apple iPhone & iPad ▪Android mobile devices (including Kindle Fire) Limited printing is NOT yet supported for this title. |

Save $$$ ...Buy this Book as Part of a "Bundle"

Purchasing this book as part of a book bundle gives you multiple book titles at significant savings. |

(Prices on ordering page)

Copyright © 1995-2021 Flagship Technologies, Inc. All rights reserved. Contact: info@goflagship.com

Created with Help & Manual 7 and styled with Premium Pack Version 3 © by EC Software