|

Navigation: » No topics above this level « Farm Credit Accounts Part I: The Credit Card Account Type |

Scroll Prev Top Next More |

Farm Credit Accounts Part I:

The Credit Card Account Type

September 12, 2017 - by Mark Wilsdorf

Several of QuickBooks' account types can be used for a wider range of accounts than their names imply. The Bank account type, for example, is not limited to being used for bank accounts. You can use it for working with any account which operates like a bank account, such as a PayPal account, or a clearing account (used for moving funds around within QuickBooks). The Credit Card account type, likewise, is not limited to being used for what most of us think of as "credit cards"—MasterCard, VISA, American Express, etc. You can use it for any account which operates like a credit card account. A number of credit sources popular in agriculture seem to work like a credit card...but should you use the Credit Card type for them? That's a question we'll be answering in this article series. |

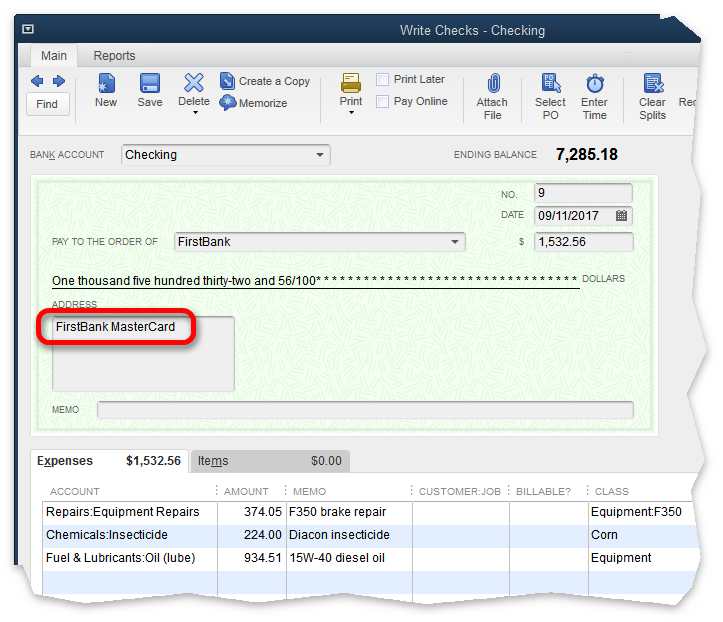

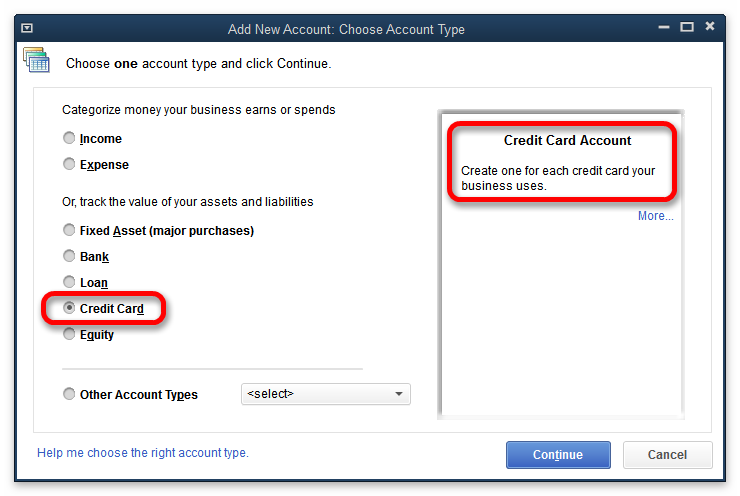

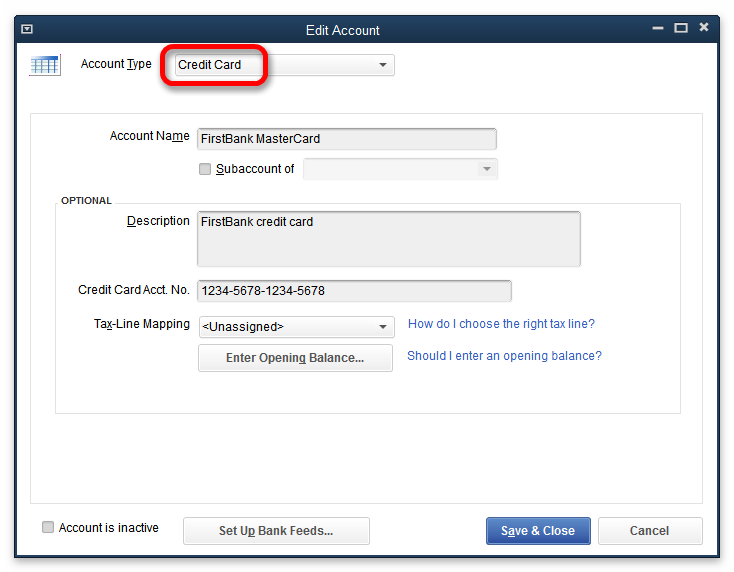

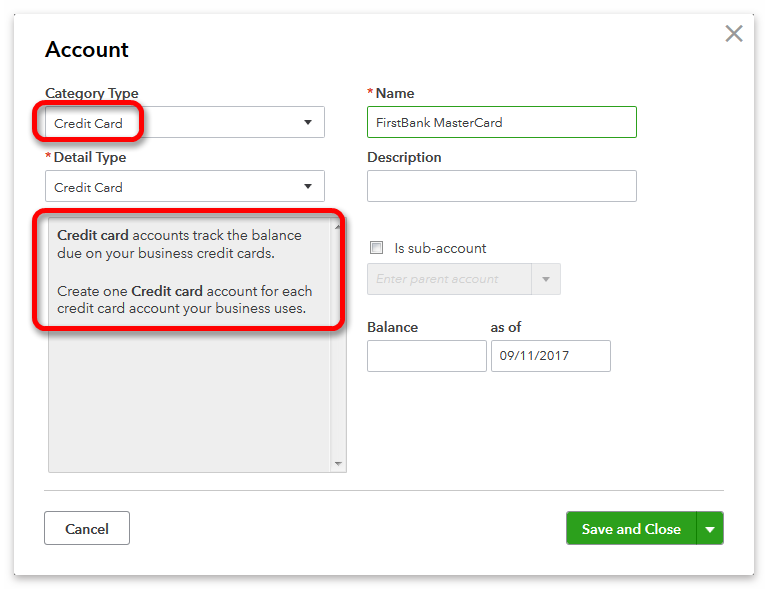

Before we look at using the Credit Card account type for farm business credit accounts, let's consider the two most common ways credit cards are handled in QuickBooks:

|

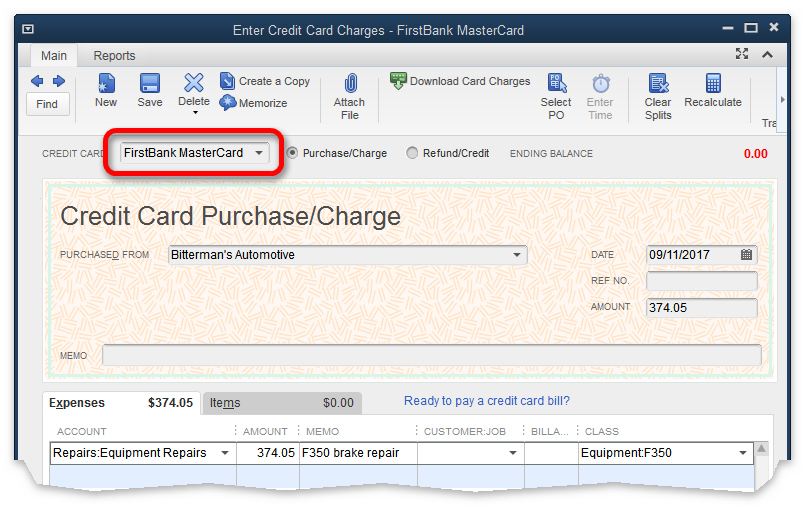

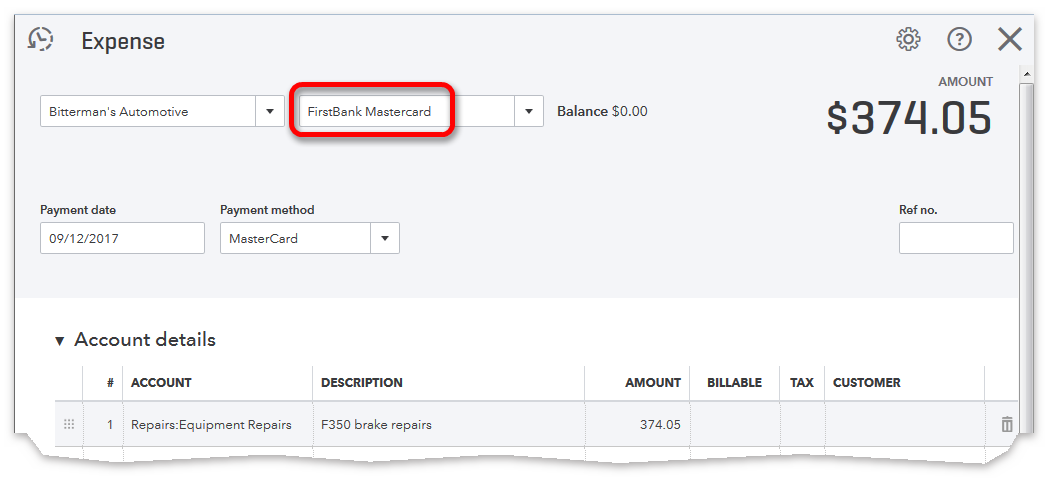

Just writing a check each month to pay the amount you owe is OK for credit cards used solely for personal spending. But if a credit card (or other credit accounts we will discuss later) is used for farm business purchases, you should be using a Credit Card-type account for working with it in QuickBooks. Here are reasons for using a Credit Card-type account: ❖It lets you keep track of more information about purchases. The Enter Credit Card charges form in QuickBooks desktop editions, or the Expenses form in QuickBooks Online lets you identify each purchase with a specific vendor. (Entering credit card purchases as details lines on a check does not.) You can get a report showing all transactions with a particular vendor, which can be useful for hunting down errors or problems with an account, or simply when you want to find a particular transaction you've made with a particular vendor. ❖It can simplify recording deductible expenses. How? If you were just entering checks to make monthly credit card payments, you would need to enter farm expense details on those checks. What will happen then, if you make a payment that is less than the full amount of an expense? Example: Suppose you've used a credit card to pay a $1,500 tractor repair bill. When the card's statement arrives, if you make a $30 minimum payment by check you will only be able to deduct $30 of the $1,500 total on that check. Next month, if you pay $75 of the card's balance, you will be able to deduct another $75 of the $1,500 total. And so on—getting large deductible expenses recorded can be difficult and messy with this approach, if you are just making partial payments. With a Credit Card-type account though, entering expenses is separate from making payments on the card. You would enter the $1,500 expense all at once on the Enter Credit Card Charges form (Expense form in QuickBooks Online)—and in the tax year when the purchase was made, not when you pay the credit card balance. Making a partial payment on the card then, won't delay recording deductible farm expenses that were paid for by credit card.

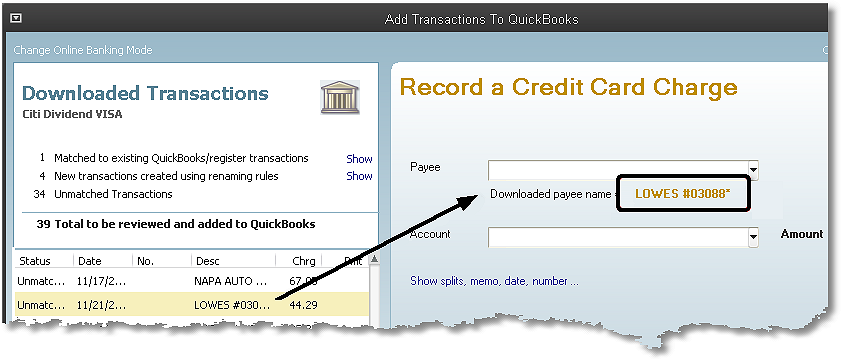

❖It lets QuickBooks automatically keep track of unpaid balances on credit accounts. When you enter purchases on the Enter Credit Card charges form in QuickBooks desktop editions, or the Expenses form in QuickBooks Online, they increase the balance in the Credit Card-type account you established to represent the credit card (or other credit account). If you only pay part of what you owe, the unpaid balance in that account will appear on balance sheet reports as a current liability of the farm business. ❖It lets you reconcile the charges you have entered in QuickBooks, against the monthly credit card statement. QuickBooks's Reconcile window makes it easy to reconcile a Credit Card-type account against the statement. But if you simply write a check each month to make credit card payments, reconciling is a very manual process. This may not seem like much of a problem if you pay off the card's entire balance each month, but if you make partial or advance payments, or dispute a charge, etc., reconciling the account can be a real headache. (That's the point where many people just give up and assume that the credit card company's numbers are correct!) ❖It offers the possibility of downloading credit card transactions into QuickBooks. Downloading transactions can save time you would have otherwise spent entering them manually. This is especially true after the first few times you've downloaded transactions, because initially QuickBooks must be "trained" to automatically match transactions with the vendor names and expense accounts you typically use, such as repairs or supplies. Downloading credit card transactions only works if you set up a Credit Card-type account in QuickBooks, to accept the downloaded transactions. Not all credit card issuers support transaction downloading, but more of them will as time goes by. I am not yet aware of any agriculture-specific credit accounts which let you download transactions, but data interfaces between financial systems are becoming more uniform and standardized, so don't be surprised if someday you can download transactions directly from John Deere Financial, CNH Industrial Capital, or AgriBuy, for example.

|

Point-of-sale credit is credit you obtain on the spot while making a purchase. Credit cards are one of several forms of point-of-sale credit. "Store cards" (like those from Sears or Home Depot) and dealer/vendor credit (open accounts) are two others, as are credit accounts targeted at agriculture and offered by companies like John Deere Financial, CNH Industrial Capital, AGCO Finance, and more than a dozen others—machinery companies, farm input suppliers, and agricultural lenders. Setting up a Credit Card-type account is a good way to work with some kinds of credit accounts but not all of them, and there are income tax considerations to be aware of. As you will see in Part II of this series, having a shiny plastic card to carry in your wallet is not what determines when using the Credit Card account type is the right thing to do. |

Disclaimer

Articles and discussions on this site are representations of the author(s)' personal opinions only and are provided "as is" without any guarantee that the information they contain is accurate or that it applies to your particular situation. You assume all risk in interpreting and using the information provided. When in doubt, seek the advice of a competent professional in matters such as accounting, law, and taxes.

If you wanted proof that Mark always has at least one foot in agriculture you might look around his office at home....where you would find things like a folder of soil test reports, calf obstetrical supplies, a seed sample waiting on a germination test, a stack of machinery parts catalogs, and a lariat he will never really learn to use well. |

The entire contents of this site is Copyright © 1995-2021 Flagship Technologies, Inc. All rights reserved. However, Flagship Technologies, Inc. grants limited permission to use content from articles in the QB Ag Center as described below.

|

Copyright © 1995-2021 Flagship Technologies, Inc. All rights reserved. Contact: info@goflagship.com

Created with Help & Manual 7 and styled with Premium Pack Version 3 © by EC Software