The name "Cookbook" comes from how books in the series present transaction examples: each is a self-contained description of what you need to know about entering a certain type of transaction, much like a recipe describes the ingredients and steps for making a cake. This format lets you find answers to your accounting questions quickly...without the need to read several chapters for background information.

Getting Started with Raised Farm Inventories

Chapters 1 through 5 (pages 1 - 112) lay the groundwork for working with resale items in agriculture. They describe the accounting ideas involved, and provide the details you need for setting up accounts and Items in QuickBooks, to work with resale livestock and other resale items. One of the chapters provides a complete set of "visual examples" for working with resale livestock (stocker cattle) and resale produce (three varieties of resale apples). There's also a Resale Inventory Nuts & Bolts chapter—a reference you can refer back to for accounting details you will need in later chapters.

Some topics in chapters 1 through 5:

❖Three types of cash basis inventory: raised, resale, and expense-related

❖An overview of working with resale items in QuickBooks

❖Resale livestock example: stocker cattle

❖Resale produce example: apples

❖Turning on QuickBooks' inventory features

❖Accounts for resale inventories

❖Items for resale inventories

❖Making inventory adjustments

❖Getting existing resale inventories into QuickBooks |

Farm/Ranch Inventories: Practical Applications

Chapters 6 through 11 (pages 113 - 238) are devoted to step-by-step procedures for working with farm resale items in QuickBooks, with abundant screenshots and tips along the way to help you understand the steps and related accounting and/or tax issues. This part of the book shows how to enter purchases, sales, closeouts, resale item transfers between Items or to fixed assets, livestock death loss or other inventory losses (spoilage, theft, etc.) deposit sale proceeds in the bank, get detailed purchase and sales reports, and more.

Some topics in chapters 6 through 11:

❖Cash and credit purchases, in the real world

❖Entering cash purchases (checks)

❖Entering credit purchases (bills)

❖Handling freight charges...the right way!

❖Using other forms of payment (credit cards, etc.)

❖Entering cash sales (sales receipts)

❖Entering credit sales (invoices)

❖Special topic: when resale livestock give birth

❖Adjusting for resale item losses (livestock deaths, etc.)

❖Adjusting for resale item use/consumption

❖Depositing payments you have received

❖Common reports for Items: inventories, purchases, and sales

❖About financial reports

Topics are "compartmentalized" to make them a handy quick reference: each example is a self-contained description of a particular accounting problem, along with details about the transaction entry or action to take in QuickBooks to handle the situation.

|

The QuickBooks Farm Accounting Cookbook™ series was written specifically for farmers and ranchers. It was designed from the ground up to help with setup, learning, and effective use of QuickBooks in a farm business. And as a QuickBooks reference, the Cookbook series provides quick answers to farm accounting questions, with a minimum amount of reading.

The Cookbook series also appeals to other audiences. Accountants working with farmers and ranchers who use QuickBooks find the series a valuable reference for helping their clients with QuickBooks setup and operation. The same is true of other professionals such as Extension agents and agricultural lenders.

Teachers in vocational agriculture and community education programs find the Cookbook series useful in the classroom as a source of examples and ideas. Some QuickBooks trainers are even using it as a student text in QuickBooks-based farm accounting classes.

|

Volume III of The QuickBooks Farm Accounting Cookbook™ series is meant for QuickBooks users who have at least been introduced to the basics of setting up and using QuickBooks in agriculture. (If you are just getting started with QuickBooks, Volume I is the best place to start.)

Intermediate QuickBooks users will appreciate the quick-reference design of the Cookbook: short to-the-point topics indexed by commodity, problem type, and example. Self-contained chapters provide quick answers—without reading the entire book.

Advanced users will appreciate the special sections and "sidebar" discussions of advanced techniques and QuickBooks operating details, which show how to go beyond the basics to accomplish your record keeping goals.

|

Mark Wilsdorf has worked with agricultural software and accounting since the 1980s, as editor of AgriComp Magazine, as an accounting newsletter columnist, and as a developer of software, user guides, and training programs for the University of Missouri, Deere & Company, and others. He currently is president of Flagship Technologies, Inc. where his primary focus is on QuickBooks-related software and end-user training.

|

Buy Now

(Prices on ordering page)

|

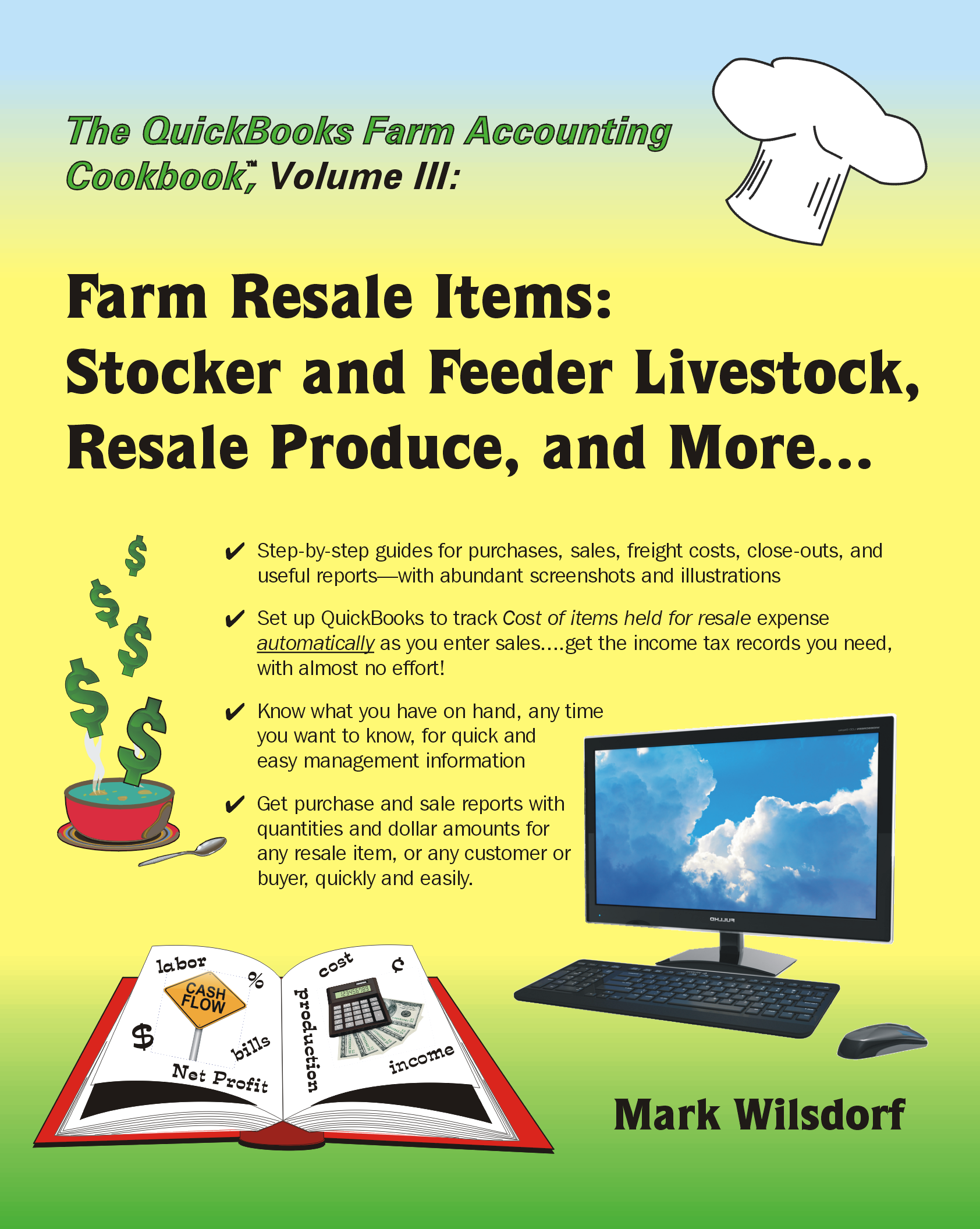

![]() The QuickBooks Farm Accounting Cookbook,™ Volume III is focused on purchases, sales, and inventories of farm resale items such as resale livestock and produce. (250 pages)

The QuickBooks Farm Accounting Cookbook,™ Volume III is focused on purchases, sales, and inventories of farm resale items such as resale livestock and produce. (250 pages)