|

The following items are free downloads...enjoy!

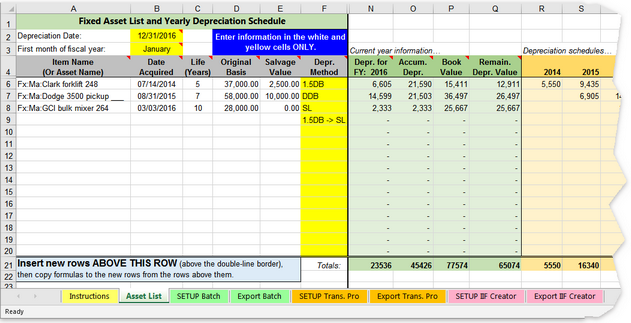

Depreciation spreadsheet template lets you maintain an asset list in the template, calculates annual depreciation for each asset (including partial first- and last-year depreciation), and creates depreciation expense transactions for importing into QuickBooks. Full instructions for using the template and for importing transactions are provided in our new book, Simple/Smart Fixed Asset Handling in QuickBooks, by Mark Wilsdorf.

The template is provided in .xlsx and .xls file versions. The .xlsx version (recommended) works in most Microsoft Excel editions. The .xls version may be needed in some Excel-compatible spreadsheets such as OpenOffice Calc, or old editions of Microsoft Excel, which do not properly handle .xlsx files.

Download: |

.XLSX template for calculating depreciation. |

|---|

Download: |

.XLS template for calculating depreciation. |

|---|

Download: |

Using QuickBooks from Anywhere: QuickBooks Online, Remote Access for QuickBooks Desktop, the Cloud, and More, by Mark Wilsdorf. Copyright Flagship Technologies, Inc., 2016 |

|---|

Copyright © 1995-2021 Flagship Technologies, Inc. All rights reserved. Contact: info@goflagship.com