If you raise grains or a similar commodities and you use one of the QuickBooks desktop editions (Pro, Premier, or Enterprise), then you really, really, really should be using Inventory Part Items to track production, storage, and sales of the crop. If you don't, you are missing out on a boatload of benefits which you can have with very little "accounting cost"—a minimum amount of effort required on your part. Those benefits include:

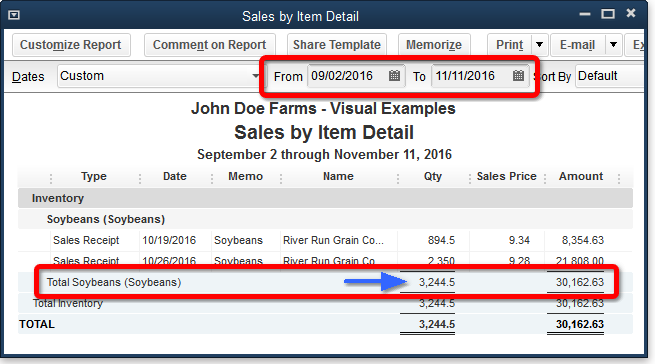

❖Tracking sales quantities as well as dollar amounts automatically—all you have to do is enter sales in QuickBooks using Items. (Each time you enter a sale QuickBooks records the quantity sold and updates the Item's remaining quantity on hand.)

❖You will be able to get reports showing grain or other commodity sales for a particular period of time (e.g., last year, last month), to a specific buyer, from a specific storage location (bin, commercial storage, etc.), or for a particular farm or landlord.

❖Having quantities and dollar amounts lets you calculate the average selling price for a crop with very little effort.

❖At any time, a quick look at the Item List in QuickBooks can tell you the estimated remaining quantity on hand for a commodity. If your Items are set up properly you can even have an estimated quantity on hand for each storage location, and find out what part of that quantity is contracted for sale. (Yes, you can use QuickBooks to keep track of forward contracted quantities and dollar amounts.)

❖When you prepare a balance sheet report, your current inventories will be included on the report automatically, as current assets.

OK, but...

How much extra work is required of you to make these benefits possible?

Mostly, you need to adjust an Item's inventory quantity after harvest has been completed for the commodity it represents. For instance, if you raise soybeans you might have an Inventory Part Item named Soybeans to use for tracking soybean inventories and sales. Each year when soybean harvest is completed, you would adjust the inventory quantity for the Soybeans Item to match the total number of bushels you estimate are on hand in on-farm and commercial storage.

Beyond that, the only other time you may normally need make an inventory adjustment would be ahead of preparing a market-value balance sheet, to update the value of your inventories to reflect current market prices.

One more thing: you don't have to use Inventory Part Items for "everything" you produce. You can set up Items for just one or two of the major commodities you raise, if that's all you want to track.

|