|

Navigation: » No topics above this level « Farm Credit Accounts Part II: Credit Cards vs. Dealer Credit and "Store Cards" |

Scroll Prev Top Next More |

Farm Credit Accounts Part II:

Credit Cards vs. Dealer Credit and "Store Cards"

September 12, 2017 - by Mark Wilsdorf

Part I explored the basics of the Credit Card account type. In Part II we discuss what kinds of credit accounts qualify as "credit cards" ("payment cards" in IRS terminology), and whether that includes any of the agriculture-oriented credit accounts provided by farm input suppliers, machinery companies, and others. |

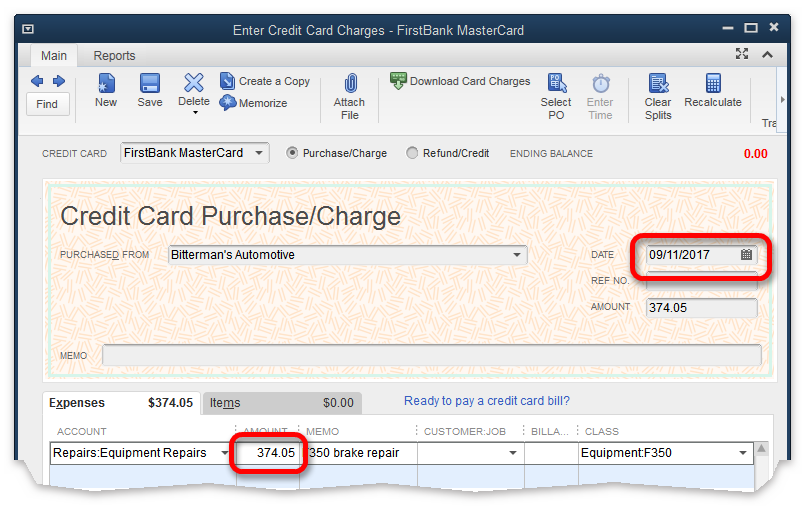

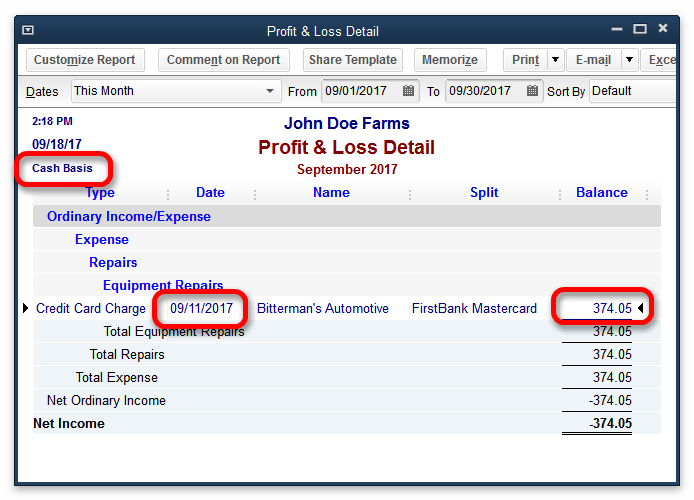

In case you missed it, in Part I I stated that the IRS considers things purchased with a credit card to be paid for as of the date of the transaction, regardless of when you pay off the card's balance. A credit card purchase is viewed as being like taking out bank loan to make the purchase: both involve taking on debt. When you take out a bank loan and then use the loan proceeds to make a farm business purchase, the purchase is immediately deductible, and the same is true when you use a credit card to make a farm business purchase. QuickBooks "knows" this by the way, and if you want, you can prove it to yourself: assuming you have a Credit Card-type account set up, (1) enter a credit card charge for a farm expense (it can be a bogus transaction which you will delete later), then (2) open a Profit and Loss Detail report for a date range which includes the transaction, and select the Cash report option to prepare the report on a cash basis. The credit card purchase will be listed right there in the report as an expense, even though you have not entered a payment on the credit card balance. Here are examples:

|

Why not? The difference is in when the IRS considers a purchase to have been "paid for"; specifically, when the vendor receives payment for the purchase. When you pay by credit card the vendor receives payment immediately (typically within 24 hours), but when you purchase something on an open account or with a store card, the vendor is not paid until you pay the bill or pay the balance on the store card account. In accounting terms, amounts you owe to dealers/vendors are considered accounts payable rather than debt. The distinction is subtle, but with debt you have an obligation to pay a third party (typically a bank, but not always), while with accounts payable you have an obligation to pay "the other party" in the transaction—the vendor or dealer from which you made a purchase.

In QuickBooks, debt is represented by setting up loan accounts—a separate loan account for each loan. When you create a Credit Card-type account you are setting up a kind of loan account which is specific to credit cards. Accounts payable, on the other hand, are entered as Bills—on the Enter Bills form in QuickBooks desktop, or the Bills form in QuickBooks Online. The total amount due on bills you have entered but not yet paid is represented by the balance in the Accounts Payable account. (You'll see Accounts Payable on balance sheet reports whenever you have unpaid bills...assuming you have entered them in QuickBooks, that is.) Does this mean the Credit Card account type cannot be used for working with store card accounts? Not necessarily. We'll talk about that in Part III of this article series.

|

First, understand that most ag-specific credit is a form of dealer (or store card) credit, because the credit is being provided by the dealer/vendor and not by a third party. For example, when you use a CNH Industrial Capital card to buy oil, filters, and repairs at a Case New Holland dealer, it essentially operates as a store card (or dealer credit) account. Though CNH Industrial Capital and your local Case New Holland dealer are financially independent (the dealership is not owned by Case New Holland corporation), their contractual and business ties prevent them from meeting the IRS definition of "unrelated" businesses. In other words, CNH Industrial Capital is not considered a third party credit provider for the purchase. But a few ag-oriented credit accounts operate as third-party credit providers in some situations. Lets use a John Deere Financial (JDF) Multi-Use account as an example... When you use a JDF account for making purchases at a John Deere dealership, it operates as a store card (or dealer credit) account. But JDF accounts can also be used at more than 100 different farm input suppliers—businesses which are completely unrelated to Deere & Company—for purchasing things like seed, fertilizer, and chemicals. Clearly, JDF is a third-party credit supplier for these farm input purchases, so shouldn't it qualify as a credit card account for those purchases? If it did, you could make a year-end purchase of seed or fertilizer without having cash on hand or taking out a bank loan, charge it to a JDF account, and the purchase would be deductible in the current tax year. Sorry, it doesn't work that way. One of the IRS qualifications for a "payment card" ("credit card" to you and me), is that it be accepted for payment among a network of persons or businesses unrelated to each other and to the issuer of the card/account. In other words, if any person or business which accepts the card/account for payment is related to the issuer, the account does not qualify as a payment card. Because a JDF account is accepted for payment at John Deere dealers—which the IRS considers "related" to JDF—it does not qualify as a payment card (credit card) account for income tax purposes. The bottom line is that purchases made with such accounts are not deductible as expense until you pay for them. Do any ag-orinted credit accounts qualify for treatment as payment card (credit card) accounts? A few, such as an AgriBuy card, would appear to qualify. But that is a discussion you should have with your tax preparer!

|

If you file taxes on a cash basis, sometimes you may want to make additional purchases of deductible expense items at year's end to reduce taxable income. Often this comes in the form of prepaying expenses for things like seed or fertilizer for the next year. If you want to prepay expenses or make other purchases of, say, $10,000 but don't have spare cash on hand at the moment, what are your options? Your two main choices are: 1.Borrow money—at a bank, or elsewhere—and use the loan proceeds to make the end-of-year purchases. Be sure the loan proceeds get recorded as being deposited in your checking account in the current tax year, and pay for the purchases by check, also dated in the current tax year. 2.Purchase farm expense items using a credit card. If your card's credit limit is large enough, you may be able to make significant purchases without making a trip to the bank or phoning your lender for a loan advance on New Year's eve day. And if you aren't sure whether the credit account you want to use will qualify as a credit card, then by all means discuss it with your tax preparer.

|

One question remains: can you use the Credit Card account type for working with accounts which the IRS does not consider payment cards (credit cards)? We'll explore that in Part III. |

Disclaimer

Articles and discussions on this site are representations of the author(s)' personal opinions only and are provided "as is" without any guarantee that the information they contain is accurate or that it applies to your particular situation. You assume all risk in interpreting and using the information provided. When in doubt, seek the advice of a competent professional in matters such as accounting, law, and taxes.

If you wanted proof that Mark always has at least one foot in agriculture you might look around his office at home....where you would find things like a folder of soil test reports, calf obstetrical supplies, a seed sample waiting on a germination test, a stack of machinery parts catalogs, and a lariat he will never really learn to use well. |

The entire contents of this site is Copyright © 1995-2021 Flagship Technologies, Inc. All rights reserved. However, Flagship Technologies, Inc. grants limited permission to use content from articles in the QB Ag Center as described below.

|

Copyright © 1995-2021 Flagship Technologies, Inc. All rights reserved. Contact: info@goflagship.com

Created with Help & Manual 7 and styled with Premium Pack Version 3 © by EC Software