Depreciable Assets: Freight & Other Acquisitions Costs

March 18, 2021 - by Mark Wilsdorf

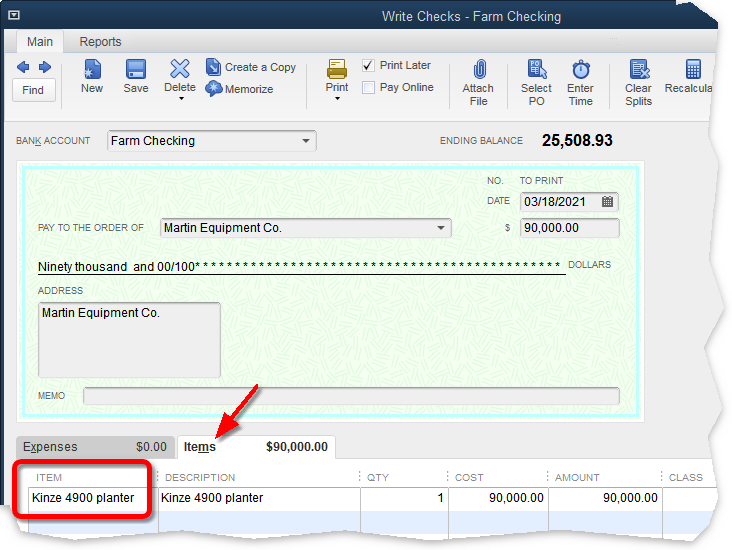

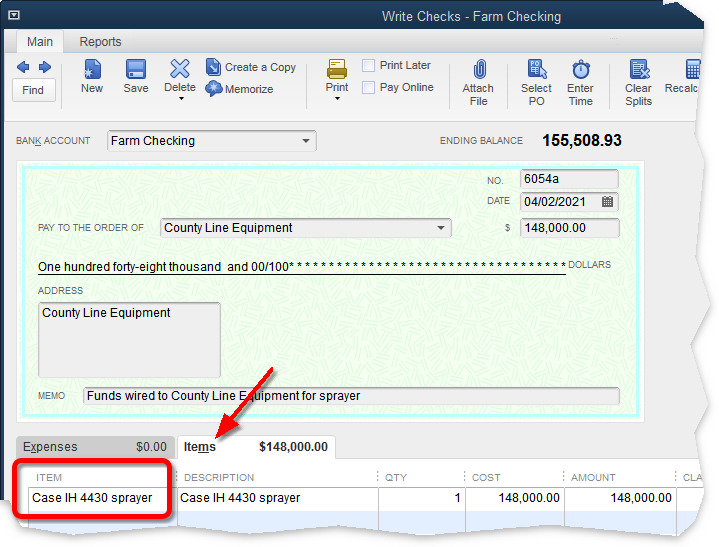

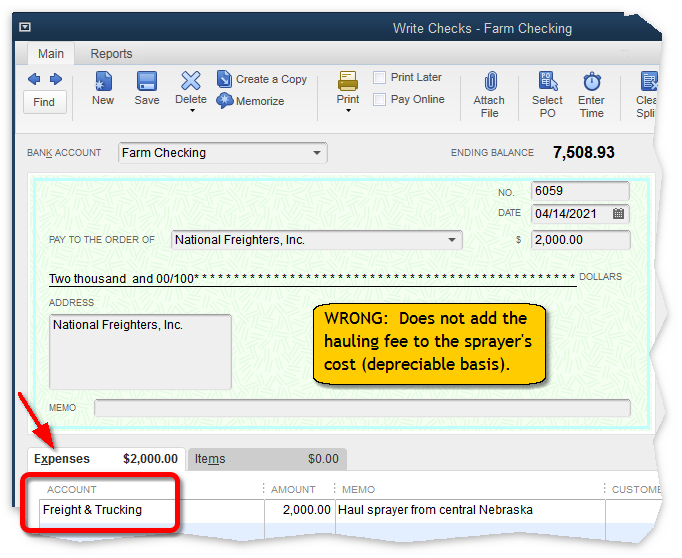

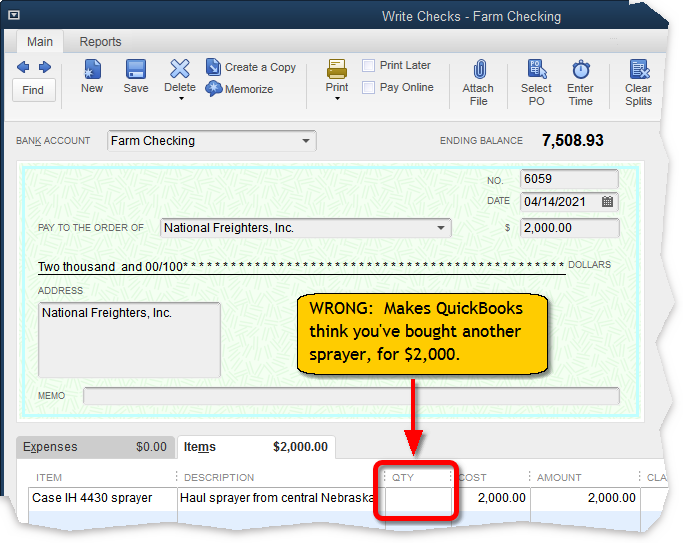

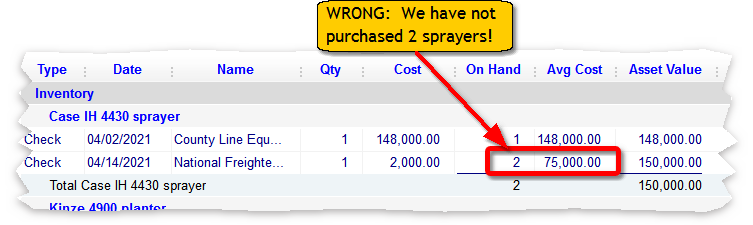

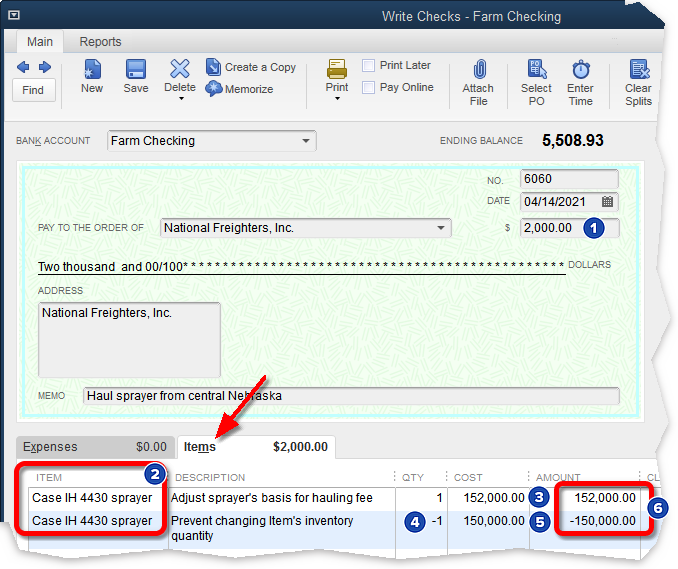

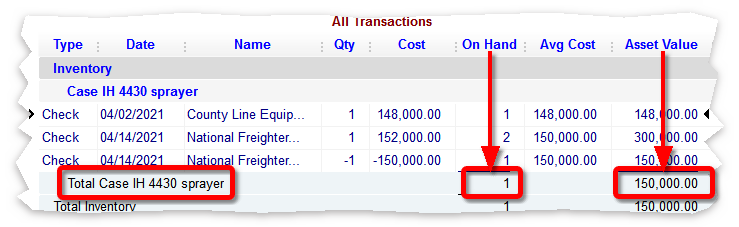

Including acquisition costs in an asset's depreciable basis is easy if they were included in the price you paid for a new piece of machinery, or a building, or a group of breeding livestock. If the purchase price included sales tax, delivery, setup, configuration charges, etc., and you wrote a check for the new asset, its depreciable basis will be equal to the check amount. But what if you paid for some of the acquisition costs separately? Maybe you paid a trucking company to deliver a tractor you purchased, or paid a neighbor to haul a group of cows you bought. In those cases, you need to add the acquisition costs to the asset's purchase price to calculate it's depreciable basis as the total of the two. The QuickBooks Farm Accounting Cookbook™ Volume IV, Fixed & Depreciable Assets: Machinery, Breeding Livestock, Buildings, and Land provides a lot of information about handling fixed asset transactions but, unfortunately, did not show how to add separately-paid-for acquisition costs to an asset's depreciable basis. The purpose of this article then, is to fill in that information gap. This article will have limited use to you unless you are using the fixed asset recordkeeping methods described in The QuickBooks Farm Accounting Cookbook™ Volume IV. |

Disclaimer

Articles and discussions on this site are representations of the author(s)' personal opinions only and are provided "as is" without any guarantee that the information they contain is accurate or that it applies to your particular situation. You assume all risk in interpreting and using the information provided. When in doubt, seek the advice of a competent professional in matters such as accounting, law, and taxes.

Copyright © 1995-2021 Flagship Technologies, Inc. All rights reserved. Contact: info@goflagship.com