Handling Prepaid Supplies...It's Easier than You Thought

July 26, 2021 - by Mark Wilsdorf

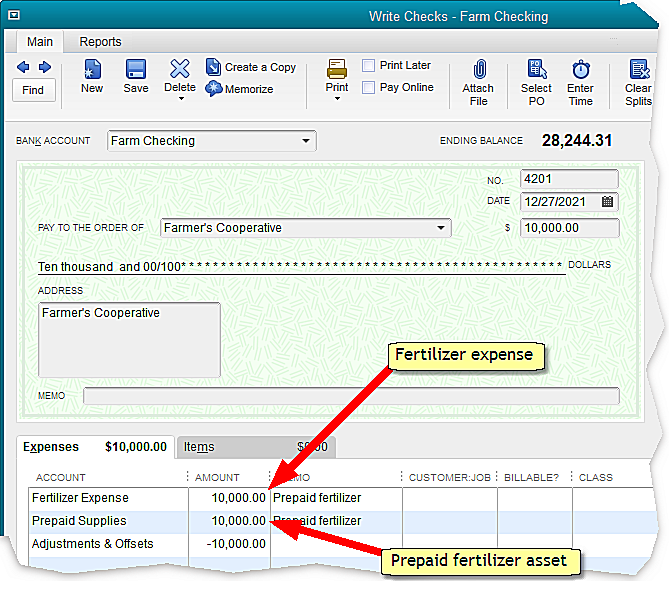

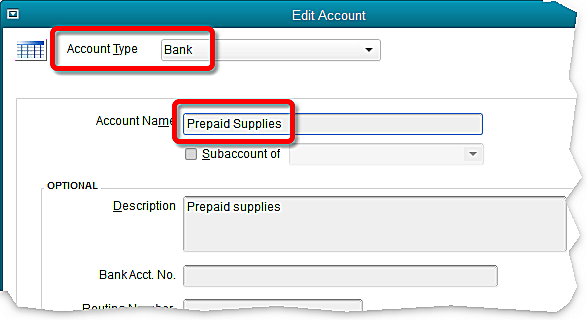

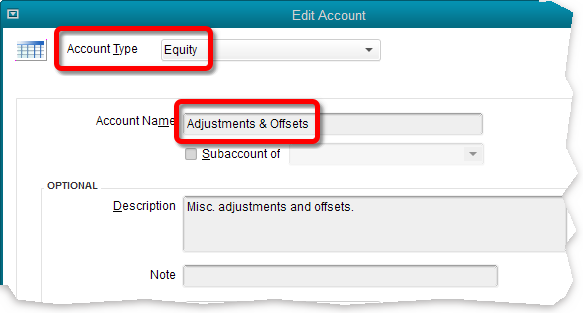

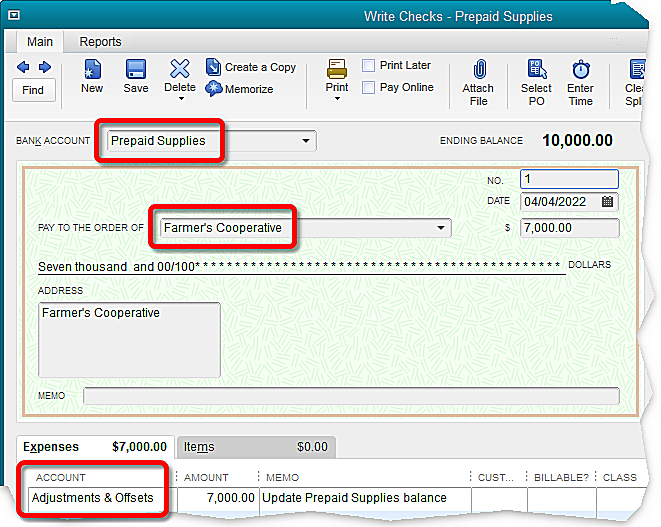

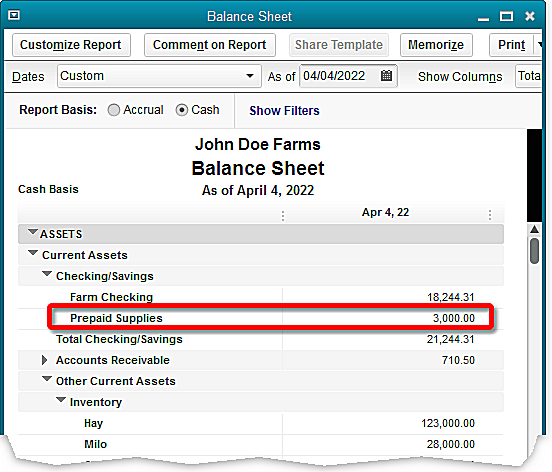

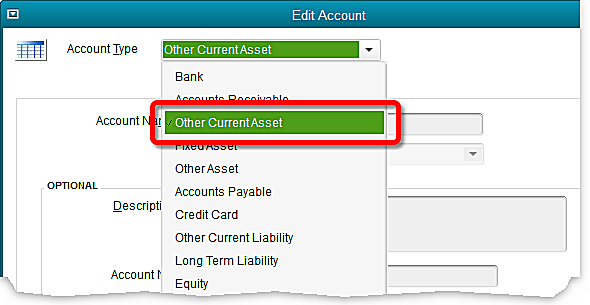

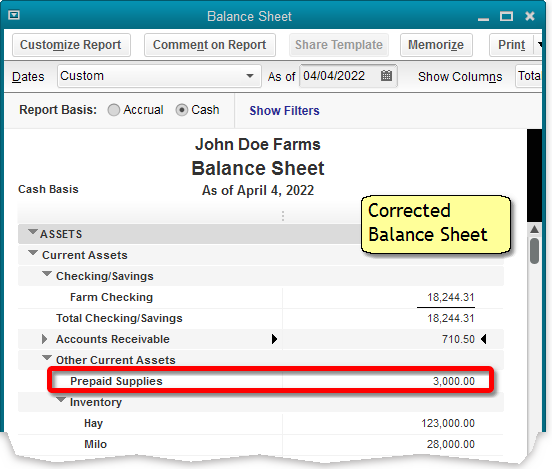

Fortunately, recording something as both an expense and an asset is easier than you might think. Let's consider an example based on prepaying for fertilizer. We will look at how to enter the check first, then follow up with information about setting up the necessary accounts, and other details. The example is based on the QuickBooks desktop editions (Pro, Premier, Accountant, and Enterprise). The same approach should work in the QuickBooks Online editions—though I have not specifically tested it there, this time—but the terminology and screen appearance will of course be different. Note: The steps shown in this article work for any kind of prepaid expenses, not just fertilizer. |

Disclaimer

Articles and discussions on this site are representations of the author(s)' personal opinions only and are provided "as is" without any guarantee that the information they contain is accurate or that it applies to your particular situation. You assume all risk in interpreting and using the information provided. When in doubt, seek the advice of a competent professional in matters such as accounting, law, and taxes.

Copyright © 1995-2021 Flagship Technologies, Inc. All rights reserved. Contact: info@goflagship.com