|

Try it FREE for 30 days! |

Pricing & purchase

|

New FormCalc SST versions 3 & 4 adds even more power, convenience, and flexibility for meeting your QuickBooks calculation needs...

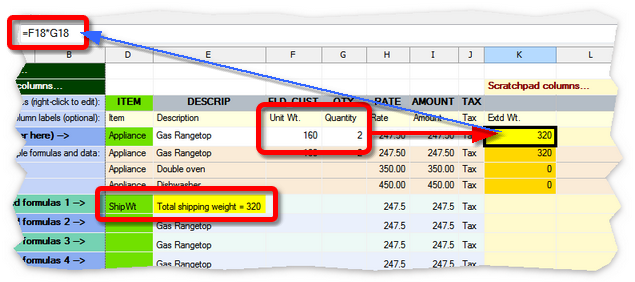

The Scratchpad is an area on the Snapshot tab, to the right of the columns which represent native columns of the QuickBooks form. It consists of ten blank columns colored with a light yellow background. In the Scratchpad, you can enter formulas which refer to the native QuickBooks columns. Also, formulas entered in the native columns can refer to cells in the Scratchpad.  In the example above, a formula entered on the Formulas row of the Scratchpad, =F18*G18, will calculate an extended weight for each line of an invoice, by multiplying the Unit Weight by the Quantity on each line. Presumably, a trigger Item named ShipWt will be selected somewhere toward the bottom of the invoice, and it will total the Extd Wt. column of the Scratchpad, to provide a total shipping weight for the entire invoice. The Scratchpad lets you do things like create subtotals and totals of the QuickBooks form's columns, or do other intermediate calculations, without adding additional custom columns to the QuickBooks form (Invoice, Sales Receipt, etc.). This provides several benefits: ❖Using the Scratchpad can free up custom fields for other uses in QuickBooks. This can be especially important if you need a large number of custom fields (columns) for data but the number of custom fields available in your QuickBooks edition (such as QuickBooks Pro) is limited. ❖Sometimes, you may be able to add new calculations for a QuickBooks form without taking a new snapshot of the form. If you can add the new calculation in a Scratchpad column instead of modifying the form's layout, taking a new Snapshot won't be necessary. ❖The Scratchpad lets you do some kinds of calculations more simply than if all formulas had to be entered in (match up with) native QuickBooks columns. For instance, in some situations the Scratchpad lets you avoid using long formulas containing IF() statements. ❖Using the Scratchpad often makes FormCalc SST run faster! How? If you can remove custom columns from the Items area of a QuickBooks form (because they are no longer needed for use by FormCalc SST), the form will have fewer columns for to travel over as it gathers data and processes calculations. Fewer columns to travel over means quicker operation! |

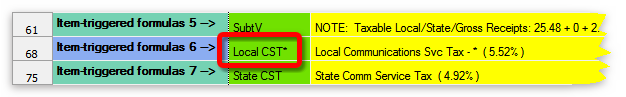

Now you can use wildcards in Item names you enter in FormCalc SST for Item-triggered formulas. This allows you to apply the same calculation formula to a range of related Item names instead of only a single matching name.  FormCalc SST can match Item names in either of two ways: ❖Exact match. This happens when an Item name you have entered in FormCalc SST exactly matches an Item name in QuickBooks. Exact matching ignores capitalization however: ItemName, itemname, and ITeMNAMe would all match a QuickBooks Item named ItemName. ❖Wildcard match. This happens if you have used wildcard characters in an Item name in FormCalc SST and a QuickBooks Item name is encountered which matches the wildcard name. FormCalc SST supports * and ? as wildcard characters: * matches any number of characters in an Item name, and ? matches any single character. Examples: Local CST* would match these QuickBooks Item names: Local CST Tax - Jacksonville Local Tax - Jack* would match these QuickBooks Item names: Local Tax - Jacksonville But not: Local Tax - Key West Local Tax 3?? would match all of these QuickBooks Item names: Local Tax 301 But not: Local Tax 214 |

|

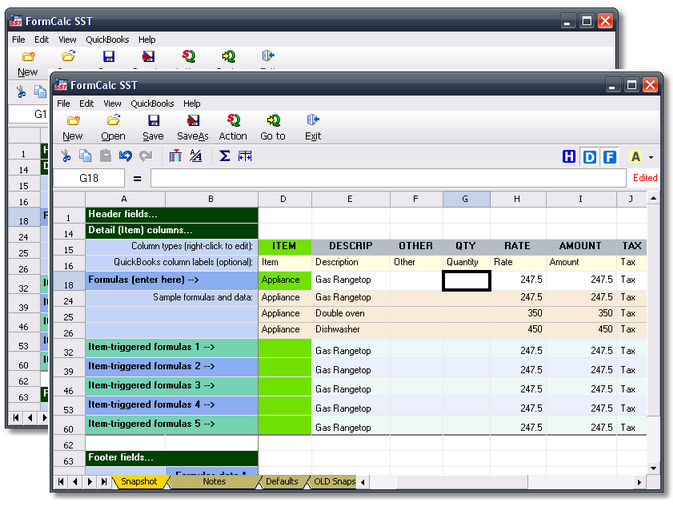

Some FormCalc SST users need to be able to do calculations on two or more different QuickBooks forms, such as Invoices and Sales Receipts, at any time—because they may enter sales on either form at any time. This was a problem in older FormCalc SST versions because they only allowed running a single instance of the program at a time. If you had a data file (*.SSF) loaded for doing calculations on an Invoice, for instance, then wanted to apply calculations to a Sales Receipt, you first had to go to FormCalc SST and manually load a different data file—one set up for working with Sales Receipts. This is no longer a problem however, beginning with FormCalc SST version 3. Now you can run multiple instances of the FormCalc SST program, and each instance (each running copy of the program) can have a different data file loaded, with a different hotkey assigned to it. So if you want to be able to quickly apply calculations to Invoices and also to Sales Receipts, you can start two copies of FormCalc SST and load a different data file into each one. (The number of FormCalc SST instances you can run at one time is essentially unlimited.) The most important consideration for running multiple FormCalc SST instances, is to assign a different hotkey to the data file (*.SSF) you load in each one. To assign a different hotkey to a data file: 1.Open the desired data file (*.SSF) in FormCalc SST (File > Open). 2.Set the hotkey in the Preferences dialog (Edit > Preferences). 3.Save the data file (File > Save) to preserve your hotkey setting for that file.

|

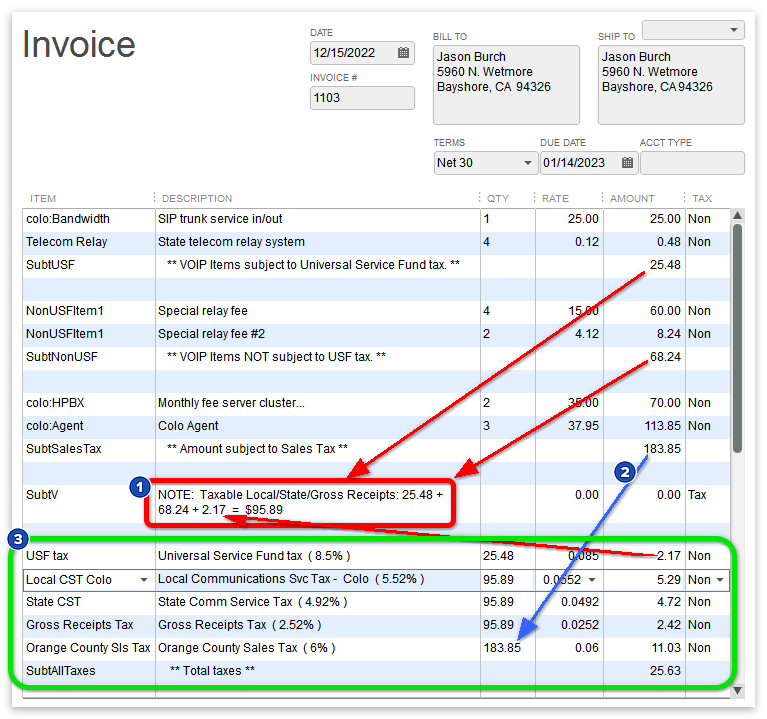

Below is an invoice for an actual FormCalc SST customer who sells communications products and services. (The Customer name on the invoice is fictitious.) FormCalc SST solved a major calculation problem for him: he must calculate five different taxes on invoices, and each tax is based on different combinations of Item lines on the invoice; in other words, no tax calculation on the invoice is as simple as QuickBooks' standard sales tax calculation approach. So QuickBooks alone was incapable of doing the calculations he needed.

The new STOR, GET, and wildcard Item name matching features let us set up a FormCalc SST data file which accomplished all of the calculations shown on the invoice above. The only things the user has to do are (1) fill out the invoice, with Item lines grouped in the various taxation categories as shown, and (2) press a single hotkey to get FormCalc SST to apply the calculations to the invoice. This real-world example only scratches the surface of what is possible with FormCalc SST version 3! |

FormCalc SST for QuickBooks is FREE to try! Just download and run the program's installer, then use the full working version of FormCalc SST for free for a 30-day trial period. If you like it, you can purchase a FormCalc SST software license(s) to continue using the program—there's nothing more to install. |

Try it FREE for 30 days! |

Pricing & purchase |

Try it FREE for 30 days! |

Pricing & purchase

|

Copyright © 1995-2021 Flagship Technologies, Inc. All rights reserved. Contact: info@goflagship.com

Created with Help & Manual 7 and styled with Premium Pack Version 3 © by EC Software