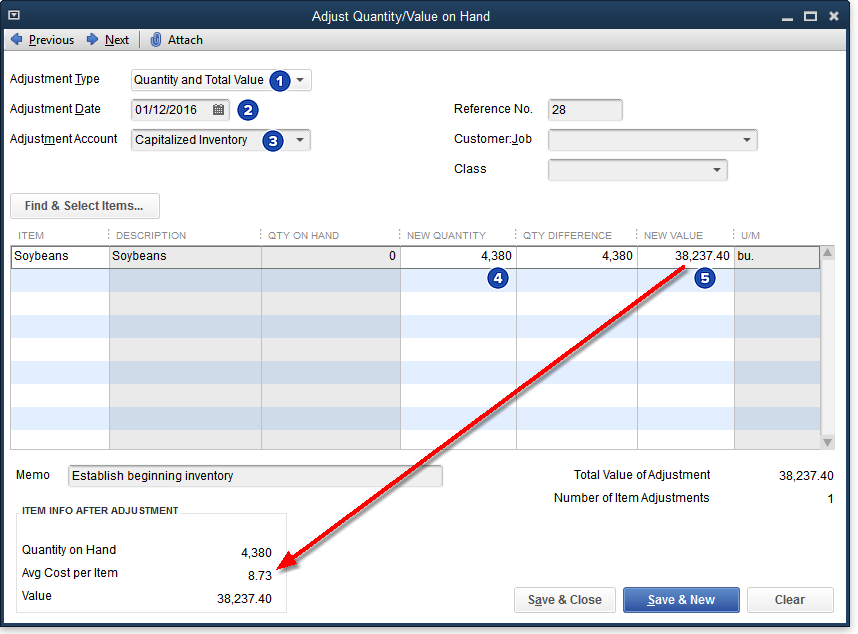

Farm Inventories Part I:

Getting Production into QuickBooks

January 15, 2018 - by Mark Wilsdorf

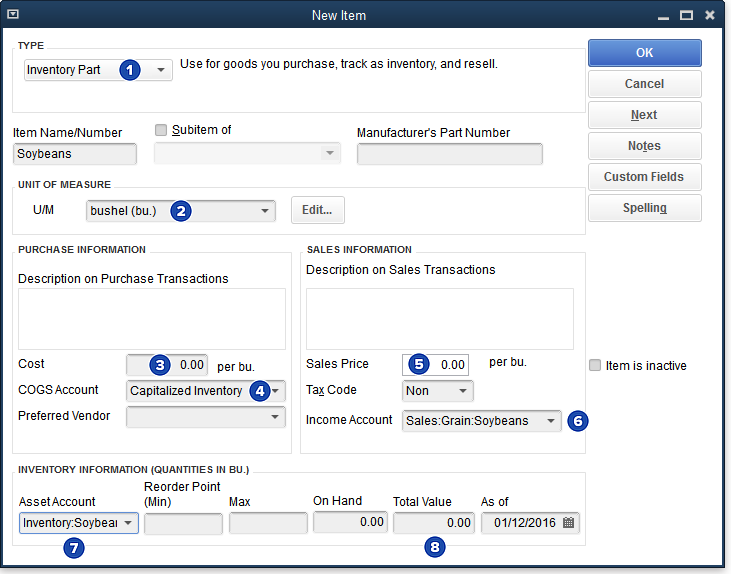

Most farming and ranching operations in the U.S. use cash accounting, and the majority prepare market-value balance sheets. One of the big hurdles these farm businesses face in using QuickBooks, is how to get inventories of things the farm or ranch produces into QuickBooks, and how to assign a value to them for preparing balance sheet reports. Like those Web site ads that claim they will tell you "How to lose weight with this one weird trick...", this article introduces "one weird trick" (actually, just a simple workaround) for getting farm production into QuickBooks as an inventory, with a market value applied to it, plus a lot more. This article applies to the QuickBooks desktop editions (Pro, Premier, and Enterprise) but not to QuickBooks Online: its inventory system operates differently, preventing practical application of the article's techniques. Also, this article applies to raised farm production but not to resale items such as resale livestock. Federal income tax recordkeeping for resale items requires a different approach (described in detail in the forthcoming Volume III of The QuickBooks Farm Accounting Cookbook™ series).

|

Disclaimer

Articles and discussions on this site are representations of the author(s)' personal opinions only and are provided "as is" without any guarantee that the information they contain is accurate or that it applies to your particular situation. You assume all risk in interpreting and using the information provided. When in doubt, seek the advice of a competent professional in matters such as accounting, law, and taxes.

Copyright © 1995-2021 Flagship Technologies, Inc. All rights reserved. Contact: info@goflagship.com